Amazing!!!Jewelry Investment 2

2017-06-26 15:04:25

Diamonds, the hardest substance in nature, the gem world Kings, according to world luxury authority statistics, China has become the world's largest high-grade consumer goods, and as the first choice for jewelry, diamond in China's consumer price index is increasing year by year, it can be said that the diamond become to a certain extent, has led to consumption, investment, the collection of the new beacon.

So today's analysis, the prospect of investing in diamonds and the number of reasons to invest in diamonds. Meilanxuan woman's necessities, provide Titanium alloy jewelry manufacturer china.

So today's analysis, the prospect of investing in diamonds and the number of reasons to invest in diamonds. Meilanxuan woman's necessities, provide Titanium alloy jewelry manufacturer china.

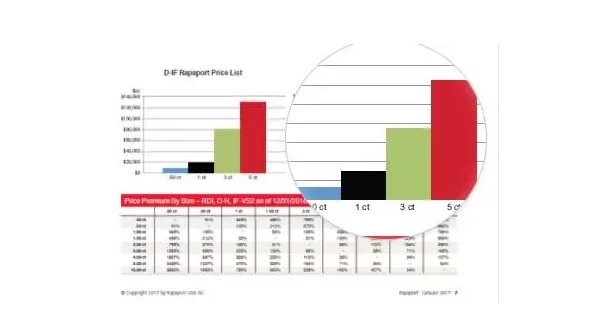

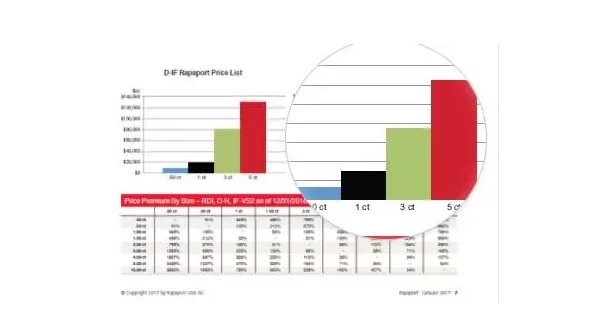

Based on the diamond price base of the Rapaport diamond price list in the past ten years, the average annual rise and level of the 1-5 carat diamond is:

Based on the diamond price base of the Rapaport diamond price list in the past ten years, the average annual rise and level of the 1-5 carat diamond is:

1 carat - up 7.0% (

2 carats - up 8.2% (d.i. F)

3 carats - up 14.3% (d.i. F)

4 carats - up 15.2% (F.V VS2)

5 carats - up 17.9% (f.vs2)

The increase data shows that the diamond rally is stable, and the high-quality diamonds of more than one carat are valuable for investment and collection. It's worth noting that at the world diamond conference in June, the price of the blank was up 20%, and the future of the finished diamond market would be bullish.

All in all, from the market's trajectory, diamond prices don't like gold ups and downs, there is no art investment risk, basic is steadily rising trend, will become the new tool for investment collection. If you need more information, please click Fashion charm rose gold plated jewelry.

4. Diamond prices are climbing year by year

Diamonds are the world's oldest gem, and the resources are not renewable, which makes diamonds more valuable and attracts more and more people to pay attention to diamonds. Looking back at the diamond market, diamonds have been steadily rising at an average annual rate of 10% a year for more than 100 years, hardly falling. At the same time, the value of the diamond varies greatly by size and quality. Meilanxuan create beauty for every woman through Stainless steel Ring wholesales.

Diamonds are the world's oldest gem, and the resources are not renewable, which makes diamonds more valuable and attracts more and more people to pay attention to diamonds. Looking back at the diamond market, diamonds have been steadily rising at an average annual rate of 10% a year for more than 100 years, hardly falling. At the same time, the value of the diamond varies greatly by size and quality. Meilanxuan create beauty for every woman through Stainless steel Ring wholesales.

5.The supply of diamonds will stagnate

Despite the high demand for global diamond jewellery in 2013, the pressure from upstream cannot be underestimated. New production in the next few years will not be able to track the expected decline in output from existing mines, which is expected to stagnate in the next five years and begin to decline in 2020.

Despite the high demand for global diamond jewellery in 2013, the pressure from upstream cannot be underestimated. New production in the next few years will not be able to track the expected decline in output from existing mines, which is expected to stagnate in the next five years and begin to decline in 2020.

1 carat - up 7.0% (

2 carats - up 8.2% (d.i. F)

3 carats - up 14.3% (d.i. F)

4 carats - up 15.2% (F.V VS2)

5 carats - up 17.9% (f.vs2)

The increase data shows that the diamond rally is stable, and the high-quality diamonds of more than one carat are valuable for investment and collection. It's worth noting that at the world diamond conference in June, the price of the blank was up 20%, and the future of the finished diamond market would be bullish.

All in all, from the market's trajectory, diamond prices don't like gold ups and downs, there is no art investment risk, basic is steadily rising trend, will become the new tool for investment collection. If you need more information, please click Fashion charm rose gold plated jewelry.